-

DIFFERENCE THAT MATTERS

New Perspectives on Assets and Services in the Era of Technology Revolution

-

MAR FOR EXECUTIVES

Creating Precedents

-

TRANSACTION POWERHOUSE

What's the Big Deal With Mega-Deals?

-

WE ASKED

New Analysis on Corporate Benefit

-

SUBSTANCE MATTERS

Recent Changes in Finnish Employment Laws

-

DIFFERENT WITH A TWIST

Poetry or Not?

DIFFERENCE THAT MATTERS

New Perspectives on Assets and Services in the Era of Technology Revolution

Today's companies are faced with limitless possibilities and massive challenges in developing their businesses to survive in the years to come. Digitalization, cloud services, Internet of Things, social media, inventive mobile solutions and novel applications are driving a myriad of successful and revolutionary businesses in all industry verticals.

To meet the clients' evolving needs in the unchartered waters of the technology revolution, it is a must-win for legal advisors to embrace technology themselves and develop an in-depth understanding of what the clients are actually going through. The ownership of traditional physical assets such as equipment, facilities and real property are quickly becoming less and less important. Smart use of assets like business data, customer databases, innovations and other intangible property has become the real lifeline of businesses.

A wide spectrum of disruptive technologies is challenging not only the traditional business models but also the legitimacy of the established legal and regulatory framework. The new global business models do not always recognize or respect the legal boundaries of the local territories and legislators in different jurisdictions are trying to keep up the pace in this constant change with varying results.

Intangible Assets as Game Changers

On November 1, 2016 we hosted a D&I Seminar on "New Digital Innovations in the Era of Technology Revolution". We had a full house of corporate legal counsels present from the largest Finnish listed companies, all eager to participate in the discussion with our men in black, the three heads of our uniquely integrated Technology, Data Protection and Intellectual Property practice groups.

Our team on stage brought forward their insights on customer data and data protection aspects, technology-affiliated contracts, trade secrets and IPR issues relating to the new digital business models that end up on the corporate counsels' desks. In addition, Kai Holkeri of D&I's Tax & Structuring practice participated through offering analysis on e.g. the choices to be made regarding ideal location of the client's data assets as a part of a holistic intangible asset portfolio. A solid and well-thought-out corporate structure is an invaluable business asset in itself, while it also protects against costly international tax disputes. Thinking ahead, a successful risk-mitigating opportunity approach requires one to step out of any and all legal silos and look at the matter at hand with a comprehensive, multidisciplinary legal mindset.

"It's all about our clients' ideas and our ability to offer holistic solutions withstanding the test of time."

Key Insights presented at the seminar:

1Data has considerable economic value. Plan and structure your organization's agreements and processes so that you can maximize its value. Make data a part of your plan in corporate restructuring.

2Trust in contracts can be grounded on a reliable third party or on a trusted transparent system. Technology maturity and introduction of new systems should be evaluated carefully.

3Digitalization changes the way agreements are drafted and their structures. Lawyers should be ready for the changes and they should understand how they affect the business environment.

4Prepare yourself for disruption. By investing in the protection, management and defence of your intangible assets you have an advantage in the inevitable changes to your firm's operational environment.

5Take advantage of the increasing compliance obligations as tools to drive your business goals.

Kai Erlund

Partner, Head of Technology & Outsourcing

Jukka Lång

Partner, Head of Data Protection, Marketing & Consumers

Henrik af Ursin

Counsel, Head of Intellectual Property

MAR FOR EXECUTIVES

Creating Precedents

MAR is the buzzword on everyone's lips. Companies have worked hard to be ready for EU Market Abuse Regulation which (in)conveniently entered into force in early July. MAR aims to preserve market integrity through EU wide uniform legal framework. Executives are integral actors in the securities market. Executives can put the procedures brought by MAR into service to contribute towards strengthening of investor relationships while building the file for the authorities.

Key Changes Brought by MAR

MAR regulates inside trading, disclosure of inside information and market manipulation. MAR is directly applicable in all EU member states and the rules should be the same everywhere. The intended uniformity is suffering from inconsistent translations as relates to managers trading. A recent correction by the EU solves the discrepancy and confirms that the Finnish translation has been correct all along. The duty to report transactions may arise also merely on the basis of managerial duties in a company without a requirement of also holding any ownership stake. It still remains somewhat blurry how the reporting duty should be interpreted. The authorities are working on guidelines which hopefully bring final clarity.

Increased process and documentation requirements and the threat of significant administrative sanctions

In line with the present practice of EU law making, MAR brought increased process and documentation requirements and a threat of significant administrative sanctions. The Finnish Securities Market Act ("SMA") has been amended to introduce the sanctions and the powers of the authorities. The maximum sanctions can rise to EUR 5,000,000 million for an individual and EUR 15,000,000 or 15% of annual turnover for a company.

Key changes brought by MAR from an operative point of view are:

- Heightened duty to disclose inside information. Matters in preparatory phase become subject to disclosure obligation earlier than under the previous rules.

- Three specific criteria for postponing the disclosure obligation. Postponing is allowed if and as long as all of the criteria are in place. The fulfilment has to be duly documented and constantly monitored. Financial Supervisory Authority must be immediately informed on postponed disclosure once inside information is disclosed to the public.

- Public insider lists are no longer kept. Issuers must maintain non-public permanent and project insider lists.

- Three-day reporting obligation on managers' trading. Applies also to their closely related persons and influence entities. The scope of reporting is widened with respect to the types of transactions and kinds of securities. Even derivatives and futures are included.

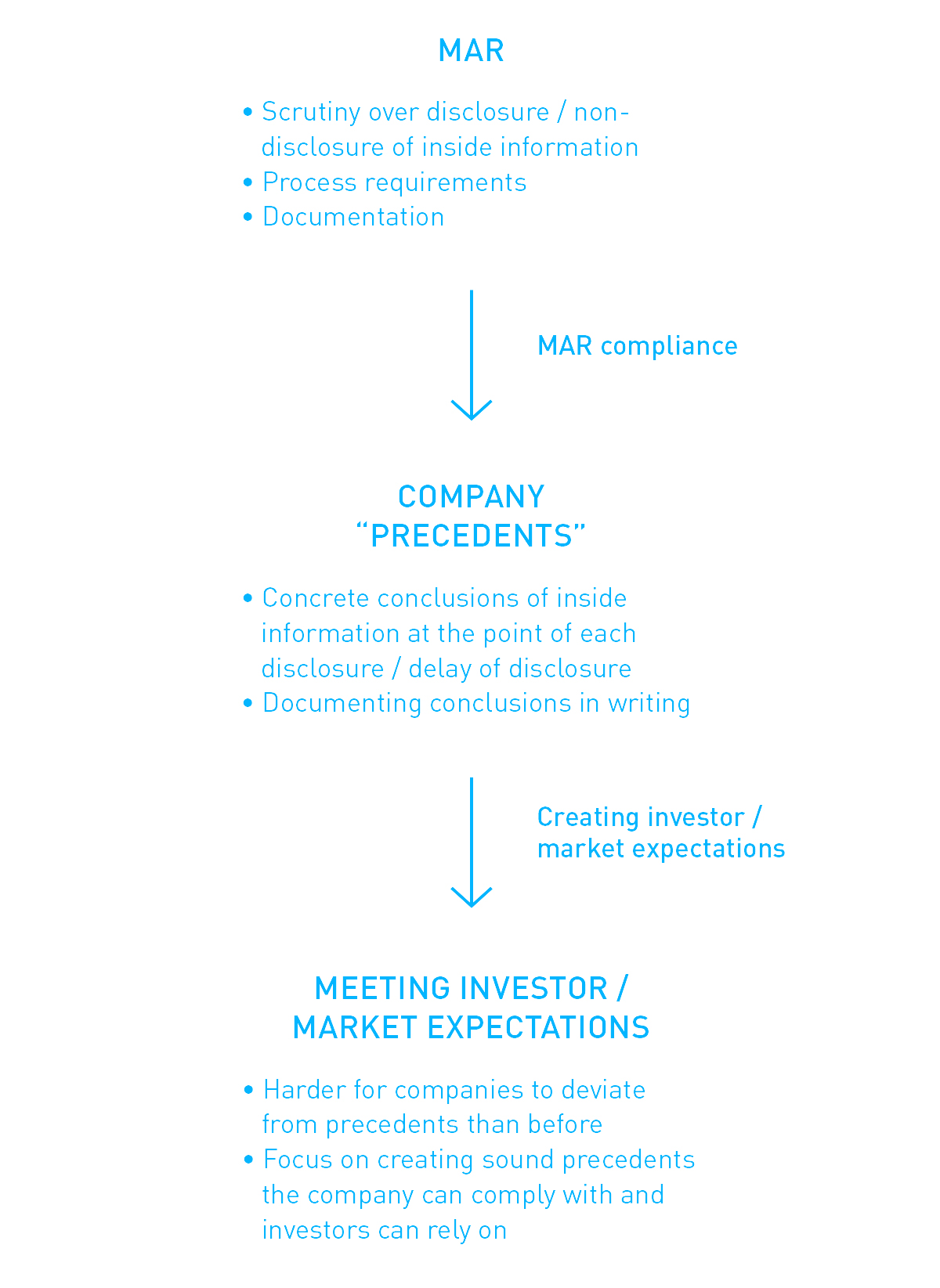

Creating Precedents

When does something "have impact on the value of the securities of the company"? What is "significant" in the circumstances where the company operates? What are the strategic aspects that need to be considered when disclosing information to the investors and to the market?

MAR creates the requirement to

- draw concrete conclusions as to what constitutes inside information at the point of each disclosure / delay of disclosure and

- document these conclusions.

Here, as in all communication, consistency is the key. The first documented decisions that are being made can build the bedrock for the future.

Investor strategy is an important factor to be kept in mind in all public communication. The strategic goals in relation to the kinds of investors the company seeks to attract and the "investor experience" that the company aims to give have to be duly reflected. MAR compliance is an opportunity to reinforce the company's investor relations strategy.

Opportunity to actively create precedents that the future disclosure decisions of the company will be measured against

MAR provides an opportunity to actively create precedents that the future disclosure decisions of the company will be measured against. You can develop, document and ingrain, internally and also to investors and other interest groups, clear definitions for the key terms which are grounded not only on the contents of MAR but also reflect the specific features and circumstances of your company. This of course is not new as such, but has a new twist. Disclosure policies need to provide clear guidelines for the definition of inside information and disclosure process to enable proper precedents to be created. In order to create such proper precedents, your internal thinking may need to go a few steps deeper to find what is core for the company. When the core is pellucid, the decisions in the hectic day-to-day life stay on course. Otherwise, the regular scrutiny which the Financial Supervisory Authority is obligated to conduct under MAR easily catches on unintentional inconsistencies.

What are the key drivers to implement new MAR rules

Jenna Nurmio

Senior Associate

Raija-Leena Ojanen

Partner, Head of Corporate Advisory, Compliance & CSR

Juha-Pekka Mutanen

Partner, Head of Finance & Capital Markets

TRANSACTION POWERHOUSE

What's the Big Deal With Mega-Deals?

Internationally big ticket M&A deals get a lot of media attention. Everyone seems to talk about mega-deals. Mega-deals certainly have some special features that need to be taken into account. Still, the issues involved in mega-deals are largely the same as in any sizeable M&A transaction. Thinking ahead and being prepared are key success factors regardless of deal size. D&I's Transaction Powerhouse lists issues to take into account when planning and executing a deal which is big from your perspective:

Structuring

1Focus on the big picture

In the current regulatory environment structuring is not only about identifying and creating tax efficient structures, but rather about facilitating business opportunities while meaningfully managing operational and business risks. In addition to tax, e.g. the allocation of data or IPRs may be a key driver in structuring transactions.

2Tried and tested structures may no longer work

The competition for tax revenues between countries and the turbulent political landscape has led to tighter and more extensive regulation and decreased the threshold of regulatory interventions. Tax structures that were applicable in the past may not be viable today or in the near future.

3Maintain long perspective and flexibility

Your tax structure should be made with a long perspective. Flexibility is key in the different stages of a company's life cycle, and a potential exit should also be taken into account in the structuring phase.

4Obtain advance comfort

Taxation is uncertain like never before. Foreseeable risks may be mitigated in advance through sensible structuring and e.g. preliminary rulings from tax authorities.

5Social responsibility pays off

Consider how the contemplated tax structure presents itself to the public. Companies can show a sense of social responsibility by paying a certain amount of tax in the country of establishment without making the structure substantially less effective.

Negotiations

It has been said that in order for negotiations to be successful, 50-80 % of the time spent on the negotiations should be spent on preparation. When negotiating a mega-deal or any other transaction of great significance, it is paramount to ensure that the parties understand each other and play by the same rules. Additional value can be created for all parties involved if the negotiation process allows the parties to focus on the essentials.

1Understand who's involved and when to talk to them

Multiple parties are directly or indirectly involved in big transactions, many of the parties not so apparent at the first glance. Mapping them all out, trying to understand their interests, and planning the sequence in which the parties (or potential parties) are to be involved in the negotiation process can make all the difference.

2Understand the other side

Do whatever you can to get an in-depth understanding of the other side, both on substance, such as their interests and best alternative to a negotiated agreement, and on their negotiating style and culture.

3Build the best negotiation team

Consider what you really need in the negotiation and who could deliver that. If you do not know the market, bring in someone who does. Often, the decision makers and negotiators should not be the same. However, do understand who calls the shots on the other side of the table.

4Negotiate the process

Before negotiating the deal itself, take time to negotiate the process. Agree on the overall schedule, when and where to meet, the agenda and how to handle the drafting process.

5Be prepared for the unknown

International negotiations are complex and are often full of surprises. Cultural differences may accentuate the challenges. Take this into account when planning the negotiation schedule and your resources.

Regulatory Approvals

Simply assessing where global M&A transactions require clearance presents considerable challenges given the number and nature of the jurisdictions involved. In many emerging regimes, notification tests are unclear, with even local advisors having trouble providing definitive guidance. In more established regimes, the administrative burden of the review process may be considerable and the authorities' requests for information remarkably extensive.

1Political interests vs. written legislation

In some jurisdictions, the tendency is that the competition and other regulatory authorities take into account public interest factors when deciding on clearance. To successfully navigate such challenges, you need to be familiar not only with the legislative framework but also the local political atmosphere and engage in discussions with relevant parties.

2Different outcomes in different jurisdictions

In multi-jurisdictional cases, the parties should prepare for the possibility that the authority in one jurisdiction approves the transaction, but a second jurisdiction subsequently disapproves it. This may happen even in jurisdictions where the authorities typically have a functioning co-operation. Concurrent filing obligations in all relevant jurisdictions need to be taken into account when planning and implementing cross-border transactions.

3Creative and innovative solutions

In many jurisdictions, authorities have become more willing to accept behavioral remedies, i.e. commitments relating to the future conduct of the parties, either standalone or together with structural remedies. To facilitate clearance, be prepared and seek to find creative solutions that satisfy the requirements under applicable laws but also the interests of the company and the public.

4Timing and preparation

The waiting times for a competition clearance vary significantly between jurisdictions and cases, and, depending on the situation, can be considerably long. The key is to initiate the clearance procedures as early as possible and be well prepared.

5Tougher sanctions for illegal early implementation

Especially as waiting times for a competition clearance can be long, the importance of proper procedures, like joint defence and clean teams, to avoid illegal pre-closing information exchange or gun jumping, should not be underestimated. Significant fines have been imposed for premature implementation of a transaction in several jurisdictions.

D&I's Recent Mega-Deals and Large Transactions

1The largest corporate transaction ever involving a Finnish company

D&I advised Alcatel-Lucent in its combination with Nokia in a deal valued at 15,6 billion.

2The largest corporate split-up ever

D&I advised Hewlett-Packard on the Finnish law and tax aspects of its separation into HP Inc. and Hewlett Packard Enterprise Company, the largest corporate split-up globally ever.

3The largest energy related deals on the Finnish market

D&I has been involved in all the largest energy related deals on the Finnish market in recent years including advising AMP Capital, a leading global infrastructure manager, and Infracapital, a leading European infrastructure investor, in their acquisition and related financing of Adven Group, a provider of critical energy infrastructure and services in Finland, Estonia and Sweden; and advising SL Capital Partners in its acquisition of Gasum's local gas distribution network, the largest gas DSO in Finland.

4The largest circular economy transaction on the Finnish market

D&I advised the Association of Finnish Local and Regional Authorities, the second largest shareholder of Ekokem Corporation, a leading Nordic circular economy company, in connection with Fortum's acquisition of Ekokem at EUR 700 million on a debt and cash free basis.

5Leading cinema operator in the Nordic and the Baltic regions

D&I advised Bonnier and Ratos in the sale of a majority stake in Nordic Cinema Group, the leading cinema operator in the Nordic and Baltic regions, to Bridgepoint in a transaction with an enterprise value of SEK 4.7 billion.

Jan Ollila

Senior Partner, Head of M&A & Private Equity

Wilhelm Eklund

Partner, Co-Head of M&A & Private Equity

WE ASKED

New Analysis on Corporate Benefit

Partner, Doctor of Laws Kari Lautjärvi has a new book "Corporate Benefit in Decision Making and Actions of the Company's Management" coming up in March 2017. Feedback from board members, managing directors and chief legal counsels of major Finnish companies suggests that there is great demand for a book on this topic.

Q: Kari, What Made You Take Up This Subject?

The role of company's management, in other words the board of directors and the managing director, is to carefully work in the best interests of the company at all times. The duties of care and loyalty are generally considered to protect the interests of the company and thus, indirectly, those of its shareholders. I previously addressed the issue of duty of loyalty owed by the management to the company’s creditors in my doctoral dissertation, published in February 2015. In this context, I discovered that, to date, no comprehensive research has taken place in Finland to determine the definition and object of such a duty or indeed of the concept of “company interest” that lies at its core. However, as our understanding of corporate governance and corporate social responsibility evolves, this matter is becoming increasingly topical and complex.

Q: Tell Us About Your Perspective in The Book?

This book examines the duty of loyalty placed on the company's management and the concept of “company interest” central to it from various perspectives, and sets out guidelines for decision making in a variety of scenarios involving the distribution and use of company funds. Company interest is interpreted in close relation to the profit-making objective and going concern of the company's activities as well as the business reason underlying a given decision or action. It considers, on the one hand, what the members of the company’s management should do and, on the other hand, what they are allowed to do, as they seek to promote the interests of their company and its shareholders. In this context, the extent to which company's management must also consider the interests of other stakeholders in its decision making remains the key question. Modern corporate governance places a greater focus also on corporate social responsibility. The company's stakeholders and wider operating environment are increasingly relevant to determining what constitutes the most appropriate approach to ensuring the company’s long-term profitability. The purpose of a company to generate profit can be considered a normative goal that sets an objective for the management but it does not determine the means for achieving it. In order to promote the interests of the company, the management must develop the company's business and thus ensure its long-term viability in accordance with the principle of sustainable development and in line with all aspects of its corporate social responsibility commitment.

Coming Up

In April 2017 we organize a D&I seminar including panel discussion on the subject of Corporate Benefit in Decision Making and Actions of the Company's Management. The seminar will be hosted by Partner, Doctor of Laws Kari Lautjärvi, the co-head of D&I's Corporate Advisory, Compliance & CSR team.

SUBSTANCE MATTERS

Recent Changes in Finnish Employment Laws

Public discussion around the Finnish employment legislation has recently focused on the Government driven Competitiveness Pact, bypassing the less dramatic legislative changes that have already taken place. These recent legislative changes should not be overlooked. The changes affect the daily working life, HR-processes and even personnel costs of majority of Finnish employers.

The Waiting Period for the Right to Postpone Annual Holidays due to Sickness Reintroduced

The employees' right to postpone annual holidays due to sickness has been strictened as of 1 April 2016. If an employee who has accrued full annual holiday (at least five weeks) is incapacitated for work during holiday, he/she has a right to postpone the 'lost' holidays only after a waiting period of up to six days, unless the applicable Collective Agreement states otherwise. The six waiting days are calculated on annual basis, i.e., the six waiting days can consist of consecutive six days' period or up to six separate sick days.

The Accumulation of Annual Holiday during Family Leaves Shortened

As of April 2016, the employees accumulate annual holidays only during the first six months of paternity, maternity, and parental leave unless the applicable Collective Agreement states otherwise. The new, stricter rule is applied when the family leave begins after 1 April 2016.

New Obligation to Prepare a Non-Discrimination Plan

The New Non-Discrimination Act imposes a new obligation to prepare a Non-Discrimination Plan on employers employing at least 30 employees in Finland. The Non-Discrimination plan should be prepared by 1 January 2017 and it should cover, e.g., concrete measures for promoting equal treatment at the workplace.

The Employees' Right to Job Alteration Leave Strictened

Since January 2016, an employment history of at least 20 years is a precondition for job alternation leave instead of the former 16-year-requirement. Also the maximum duration of the job alternation leave is shortened in half to 180 calendar days. Dividing the job alternation leave to separate leave periods is no longer possible.

New Obligations Related to Posting of Workforce

The new Posted Workers Act applies to arrangements where a Finnish employer temporarily uses foreign leased workforce, foreign employees from the employer's group companies or foreign subcontracting.

The New Act imposes a practically significant new obligation. The employers are obliged to notify the authorities in advance of the posting of workforce to Finland. This obligation enters into force during 2017.

Key Insights

These are interesting times. Material legislative changes affecting the core of the Finnish working life will take place shortly. The Finnish Pension Reform will enter into force in the beginning of 2017. (Read More on D&I Quarterly Q1 2016). Also the Competitiveness Pact introduces new regulatory elements to Finnish working life, such as the possibility increase the yearly working time by 24 hours by (in most cases) concluding a local agreement at the workplace. Finnish employers should explore this possibility without delay.

We will continue following the development of the Finnish employment legislation and keeping You informed on the practical effects of the changing regulatory framework.

Suvi Knaapila

Senior Attorney, Co-Head of Employment, Benefits & Pensions. Joins the partnership of D&I as of 1 January 2017

Iisa Koskela

Trainee on D&I's Trainee Program

DIFFERENT WITH A TWIST

Poetry or Not?

This year the traditional cray-fish party for D&I's lawyers under 35 of age, and their friends, clients and corporate connections was organized at Forum Box, a contemporary art gallery in the heart of Helsinki. As usual, the evening was "different with a twist" (#snadistiouto) with the theme "To go poetry or not?" Here's what our guests said.

Vilma Suomi, Legal Counsel, Sanoma Corporation

Q: Poetry or not?

Definitely yes to poetry! Maybe it is because I am a lawyer but I find myself attached to words - I almost instinctively seek for true meanings and correct definitions, and want to be precise in my communication. At the same time I admire artistic expression which is free from these restrictions. If I had to pick just one my favourite poem would be Edith Södergran’s “Ihmeellinen meri”.

Q: Difference that matters?

I think you should expose yourself to differences, it is important to get out of your own bubble. Differences make people interesting, and often the best way to challenge your thinking is to talk to someone with a different view.

Tuomas Rytkönen, Legal Counsel, Finnish Energy (Energiateollisuus ry)

Q: Poetry or not?

Definitely maybe. Poetry gives food for thought and room for interpretation. Even a short poem can contain a plethora of different thoughts, ideas and views.

Legislation and legal documents should express ideas in compact format, be precise and not leave room for different interpretations. Ideally, poems and legal texts should include “the best words in their best order”.

Q: Difference that matters?

Reputation. It may take years to build it but only minutes to lose it, with significant consequences. Lawyers should strive to assist their clients in managing also reputational risk when providing legal advice. Having worked at D&I I feel that safeguarding client’s reputation is embedded in Dittmar’s culture.

Nelli Vilkko, Lawyer / Head of Public Sector, Reaktor

Q: Poetry or not?

Yes, definitely! I try to schedule something creative for every week even though Finlex offers quite a smorgasbord of poetry as well… It is essential to reserve time regularly for reading novels, writing creative stuff and going to theatre or concerts - it leads to a happier life!

Q: Difference that matters?

Small informal talk at the office makes a big difference to the general atmosphere at work - there should always be time to ask if your workmate is doing well!