On 21 November 2024, the Finnish transmission system operator (TSO) Fingrid released its final report outlining the possibilities of connecting offshore wind power to the Finnish main power grid. While the conclusions of the report are still preliminary and subject to change, it provides a comprehensive outlook on how the “Finnish approach” is shaping up.

In the following, Tuomas Tiensuu, Mikko Eerola and Iida Ollinpoika discuss the topic and provide their takeaways from the report, focusing on aspects deemed most interesting from a developer and investor perspective.

Fundamentals of the Finnish Approach

Pursuant to the Finnish approach, the project developer will be responsible for building the grid connection required to connect an offshore wind farm (OWF) to the main power grid operated by Fingrid. This resembles the approach eventually taken also in Sweden but differs from the German approach. In Germany, one of the TSOs is responsible not only for the main power grid in its control area but also for the development, construction and operation of the OWF connection lines and converter stations in the German North and Baltic Seas. As a consequence, costs for constructing and operating offshore grid connection lines are borne by the TSOs and subsequently reimbursed by the grid users.

“In offshore wind power, Finland’s competitive advantage is that potential production areas are located relatively close to the mainland.”

The Finnish approach will enable Fingrid to concentrate its efforts on developing the main power grid. The Finnish TSO has earlier committed to strengthen the mainland electricity infrastructure by investing EUR 4 billion in the grid during the next ten years. Furthermore, Fingrid is following the working assumption that offshore wind power can be constructed without subsidies or other forms of State aid. This position is in line with the current Finnish Government’s objective of promoting the clean energy transition on an arm’s length basis.

In offshore wind power, Finland’s competitive advantage is that potential production areas are located relatively close to the mainland, meaning that it is likely possible to implement the grid connections by using conventional high-voltage alternating current (HVAC) cables. Fingrid estimates that a maritime grid that would collect the production of several OWFs with significantly more expensive high-voltage direct current (HVDC) cables would probably not achieve an overall economic advantage in Finnish conditions.

“Fingrid has preliminarily identified seven potential connection points for offshore wind power in mainland Finland.”

To ensure the reliability of the Finnish electricity system, the bundling of large production concentrations (such as individual OWFs) is planned to be limited to a maximum size of 1.3 GW. To alleviate this limitation, Fingrid has studied the possibility of connecting OWFs to the Finnish main power grid through hybrid connections in the future (discussed below).

Seven Potential Connection Points for OWFs

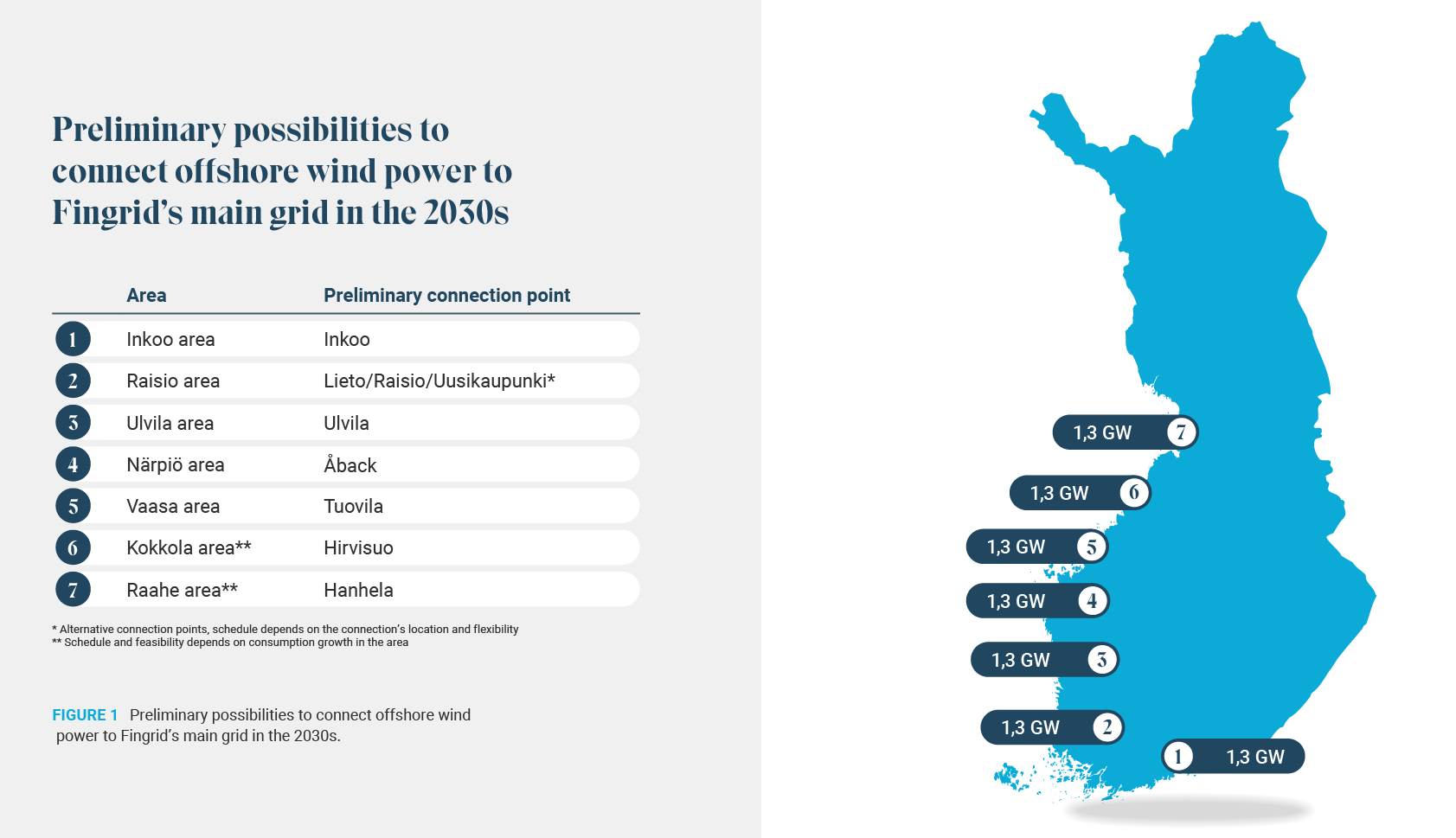

Fingrid has preliminarily identified seven potential connection points for offshore wind power in mainland Finland. As indicated in the below map, these connection points are located in the Inkoo, Lieto/Raisio/Uusikaupunki, Ulvila, Närpiö, Vaasa, Kokkola and Raahe areas.

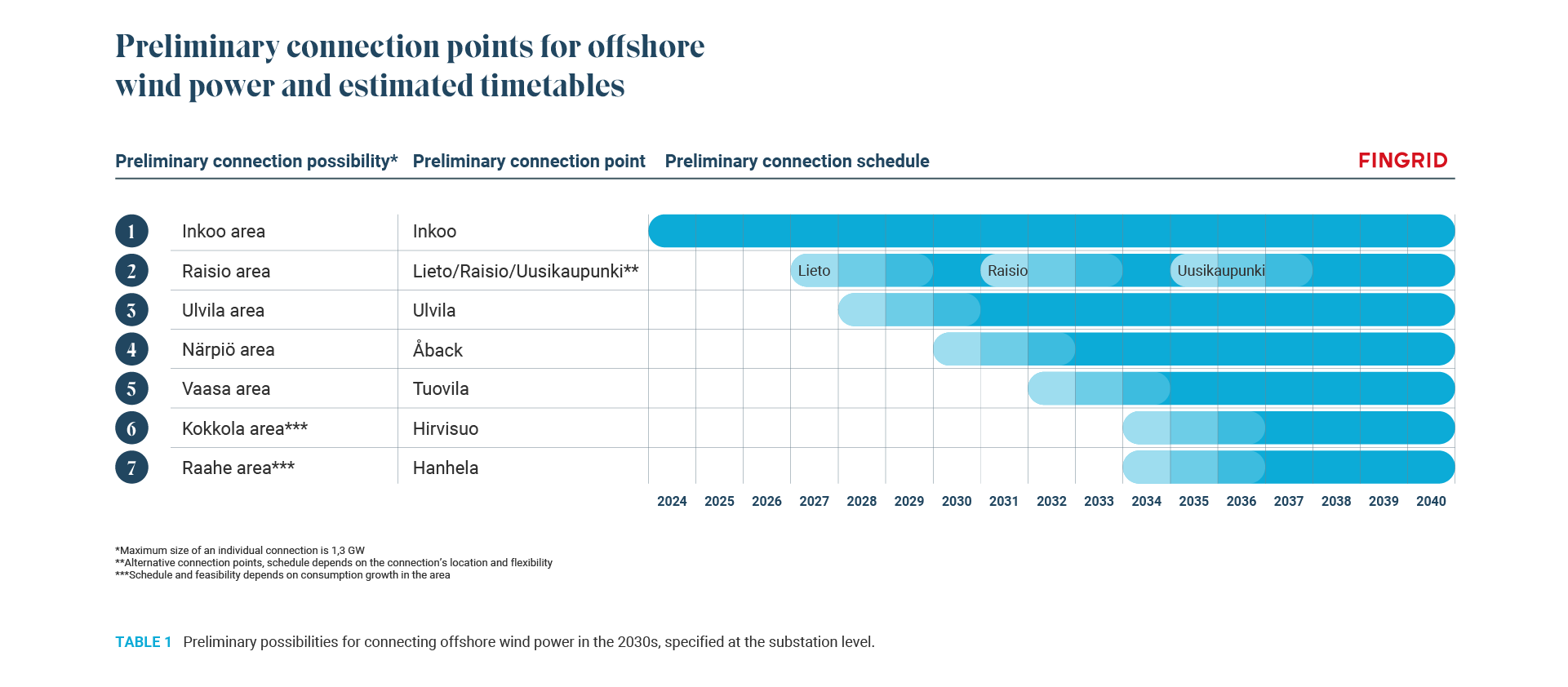

Inkoo, Lieto, Ulvila, Tuovila and Hirvisuo are existing substations in the transmission grid. Åback in Kristiinankaupunki and Hanhela in Pyhäjoki are substations planned under Fingrid’s current investment programme. Åback is due for completion in 2028, but connecting a large OWF to this substation would be possible only after additional grid reinforcements.

During the consultation round preceding the release of the report, the selected regions and estimated timetables were updated on the basis of stakeholder feedback and additional studies by Fingrid. In particular, consideration is now being given to moving the connection point in the Raisio area (alternative 2) closer to the coast of the Bothnian Sea. This is because it would be difficult to build an underwater cable connection to the Raisio area and, accordingly, the landing point would need to be closer to Uusikaupunki. For this reason, Fingrid now envisages three alternative connection points in this region. The substation in Lieto would allow a connection to take place as early as the end of the 2020s, whereas the planned substation in Raisio would be available in the early 2030s. Choosing Uusikaupunki, which is closest to the coast of the Bothnian Sea, would mean building a completely new substation in the Uusikaupunki area and could be realised in the second half of the 2030s at the earliest.

Fingrid does not expect the existing substation in Inkoo (alternative 1) to be used as a connection point for offshore wind power in the foreseeable future. This is because the Finnish Defence Forces has prohibited the construction of OWFs in the Gulf of Finland in the current security environment.

Timetable and Financing

The less the main power grid needs to be reinforced, the quicker a grid connection can be generally implemented. It is also faster if Fingrid has already planned the necessary grid reinforcements and a substation already exists or is planned.

In line with these principles, Fingrid estimates that the implementation of the connection points located in southwestern Finland (alternatives 2, 3, 4 and 5) would be possible the earliest. The feasibility of the northernmost connection points (alternatives 6 and 7) would require a significant increase in local electricity consumption. For this reason, it is envisaged that the Hanhela substation will be built once the planned consumption projects in the Raahe area progress. The preliminary timetable currently planned by Fingrid for each connection point is described in the above table.

Fingrid estimates that the implementation of these connection points would require additional grid investments amounting to a total of approximately EUR 700 million. This amount would be on top of the EUR 4 billion that the Finnish TSO has already committed to investing in the main power grid. New and reinforced 400 kV power lines would represent the bulk of the main power grid reinforcement needs for offshore wind power, which were modelled at around 1,000-1,100 kilometres. It is still unclear how Fingrid would finance such an additional investment need.

Fingrid’s current EUR 4 billion investment programme is based on a working assumption that investors would focus on investing in onshore wind projects in the 2030s. However, Fingrid’s new report envisages a different scenario in which wind power investments are assumed to lean towards offshore wind power as the 2020s end and the 2030s begin, while Fingrid’s baseline scenario remains weighted towards onshore wind power in the 2030s. Accordingly, the results of this report and the progress of OWF development will be taken into account alongside the progress of other electricity consumption and generation projects when Fingrid updates its grid development plan in 2025.

Updated Contractual Framework for Reserving Connection Points and Grid Capacity

Fingrid customarily reserves grid capacity for electricity generation projects once the project is fully permitted. To ensure the fair treatment of its customers (i.e. typically project developers or the project company owning all assets related to the underlying project), Fingrid has identified a need to update its contracting practices to accommodate large electricity generation projects, which typically take a long time to be fully permitted and require the customer to enter into significant financial commitments before all necessary permits can be obtained.

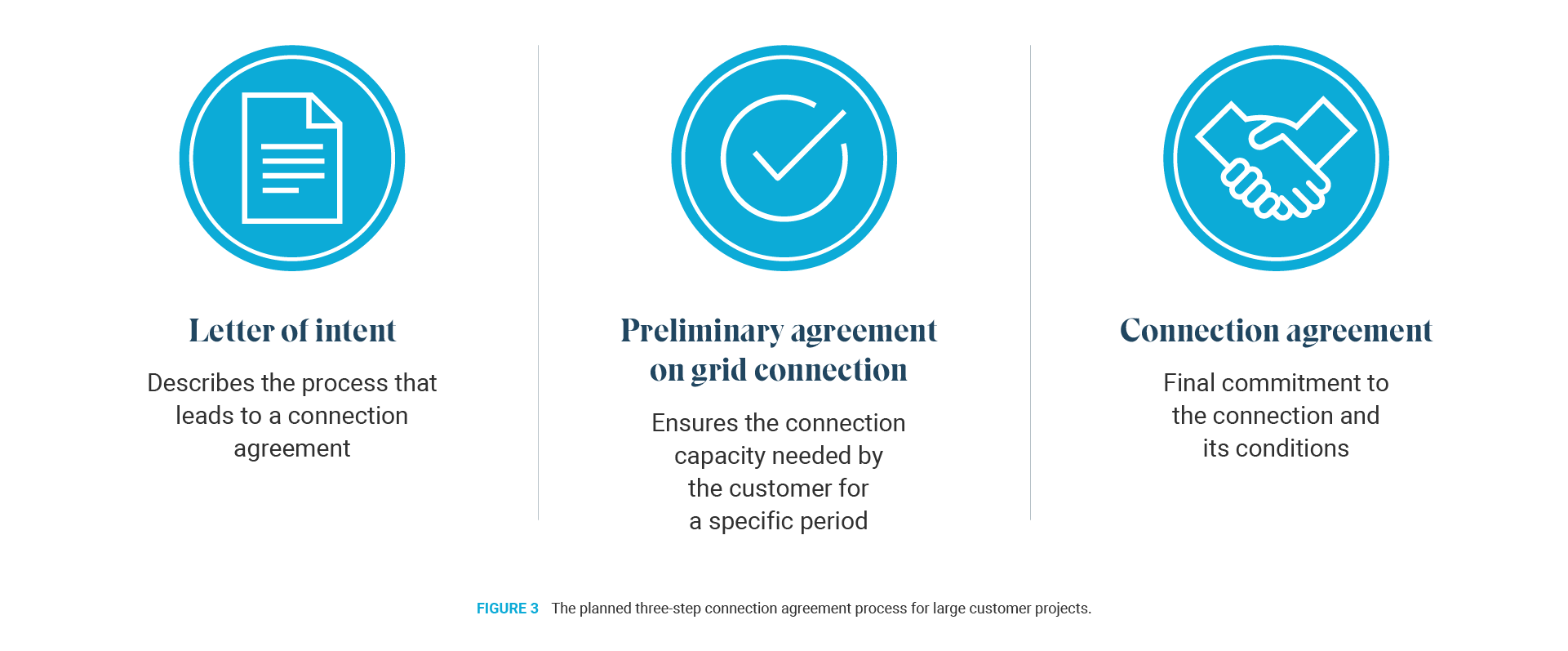

For this reason, Fingrid is planning to update its contracting framework for reserving connection points and grid capacity so that it would comprise of: 1) a letter of intent, 2) a preliminary grid connection agreement and 3) a grid connection agreement (GCA). Currently, Fingrid uses letters of intent to a limited extent (only for 400 kV connections) as well as GCAs. The preliminary GCA would, therefore, be a new type of contract.

“To ensure the fair treatment of its customers, Fingrid has identified a need to update its contracting practices to accommodate large electricity generation projects.”

A non-binding letter of intent between the customer and Fingrid, describing the cooperation and process leading to the grid connection of the project and the conclusion of a binding GCA, could be entered into at the request of the customer. It would be available if the customer has obtained site exclusivity and prepared an environmental impact assessment (EIA) programme for the project. In addition, the customer must have submitted a zoning application in areas where zoning is required (i.e. Finnish territorial waters and mainland). The conclusion of a letter of intent would, however, not yet guarantee a connection point or grid capacity.

The purpose of a preliminary grid connection agreement would be to secure the grid capacity required for an electricity generation project for a fixed period of time. A precondition for the continued validity of a such agreement would be that the customer can demonstrate project progress in accordance with the project plan. Fingrid is still considering at which stage of the project this contract type would be made available to customers as well as how to manage situations where multiple customers with OWF projects at the same stage of development are competing for the same connection point.

“The connection of hybrid power systems to the Finnish main power grid would require that the Finnish Electricity Market Act is amended to allow for such connections.”

Pursuant to Fingrid’s current practice, a customer can agree to connect an electricity generation project to the main power grid by concluding a binding grid connection agreement with Fingrid. The preconditions for concluding a GCA are expected to remain unchanged, i.e. the zoning of the project must be legally valid, the project must have necessary building permits and any expropriation permit applications that may be required for the connection must have been submitted to the authorities. Moreover, the project must be executed in accordance with the grid code specifications and Fingrid’s general connection terms in force at the time of signing the GCA. The connection fees will also be determined in accordance with Fingrid’s procedures applying at the time the GCA is signed.

Hybrid Connections

A hybrid power system can include both electricity consumption and generation. It is controlled by a joint higher-level controller, the hybrid controller, which enables different parts of the system to function independently from each other. In addition to electricity consumption and generation, a hybrid power system may also include electricity storages. In the report, Fingrid preliminarily outlines the technical preconditions for connecting such systems to the main power grid through hybrid connections. Representatives of the Finnish TSO currently estimate that hybrid connections could become technically possible in the 2030s.

The connection of hybrid power systems to the Finnish main power grid would require that the Finnish Electricity Market Act is amended to allow for such connections. The Finnish Ministry of Economic Affairs and Employment has tentatively indicated that such a legislative amendment could take place already during spring 2025. Should the amendment be implemented, Fingrid plans to enable hybrid connections with a maximum of 1,300 MW of electricity generation to the main grid. Fingrid is still studying the preconditions for hybrid connections in situations where the 1,300 MW capacity would be exceeded, as well as the power limits for consumption. In addition, Fingrid will further study hybrid connections where the customer has several connection points at one Fingrid substation.

Concluding Remarks

Offshore wind power has the potential to become a cornerstone of Finland’s energy future in the coming decades. This will require significant growth in electricity consumption, particularly in areas located in the vicinity of the planned connection points. It is therefore becoming evident that Finland’s rate of success in attracting energy-intensive investments will be a key factor driving the further growth of renewables in Finland.

After years of strong growth particularly in onshore wind, investors seem more cautious in building more onshore wind capacity in Finland due to lower revenue opportunities caused by a combination of inflated costs, high interest rates and price cannibalisation. It is difficult to predict when the investor calculus will change, and it is entirely possible that further technological advancements enabling, for example, hybrid connections will be required to make market-based OWFs a reality in Finland.

Our experienced Energy & Infrastructure team is monitoring all legislative developments affecting the Finnish offshore and onshore wind sectors, and would be pleased to discuss the Finnish approach with you. Our special thanks go to Jörg Meinzenbach and Sebastian Schneider of Hengeler Mueller for their contributions to this article.

For additional information, we recommend reading Fingrid’s original report, which is available in both Finnish and English and can be accessed through Fingrid’s website.

Source of figures and table: Preliminary possibilities to connect offshore wind power to Fingrid’s main grid in the 2030s Future scenario emphasising offshore wind power — Final report