MAR for Executives

D&I Quarterly Q4/2016

D&I Quarterly Q4/2016

Posted on

2 Dec

2016

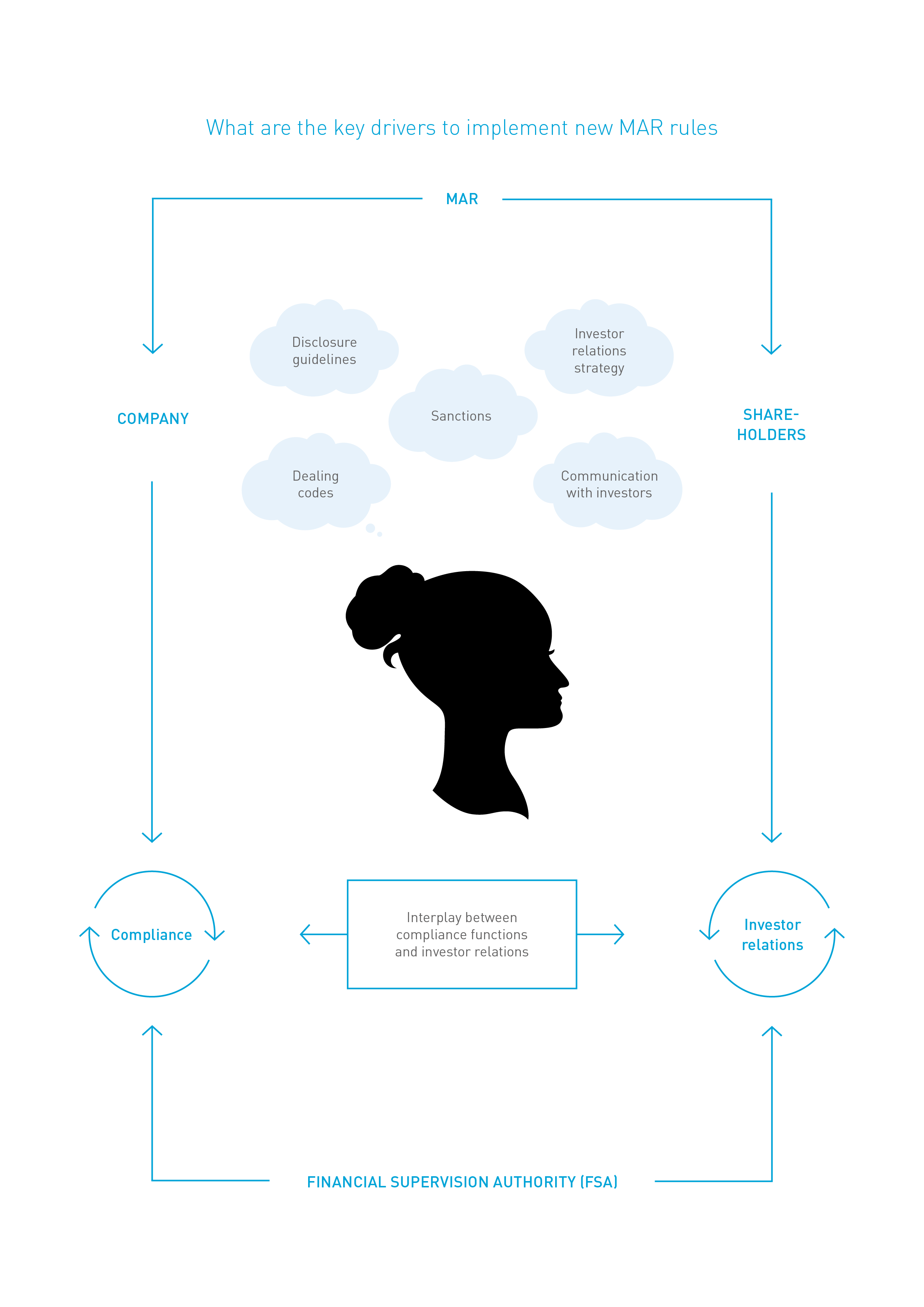

MAR is the buzzword on everyone’s lips. Companies have worked hard to be ready for EU Market Abuse Regulation which (in)conveniently entered into force in early July. MAR aims to preserve market integrity through EU wide uniform legal framework. Executives are integral actors in the securities market. Executives can put the procedures brought by MAR into service to contribute towards strengthening of investor relationships while building the file for the authorities.

MAR regulates inside trading, disclosure of inside information and market manipulation. MAR is directly applicable in all EU member states and the rules should be the same everywhere. The intended uniformity is suffering from inconsistent translations as relates to managers trading. A recent correction by the EU solves the discrepancy and confirms that the Finnish translation has been correct all along. The duty to report transactions may arise also merely on the basis of managerial duties in a company without a requirement of also holding any ownership stake. It still remains somewhat blurry how the reporting duty should be interpreted. The authorities are working on guidelines which hopefully bring final clarity.

Increased process and documentation requirements and the threat of significant administrative sanctions

In line with the present practice of EU law making, MAR brought increased process and documentation requirements and a threat of significant administrative sanctions. The Finnish Securities Market Act (“SMA”) has been amended to introduce the sanctions and the powers of the authorities. The maximum sanctions can rise to EUR 5,000,000 million for an individual and EUR 15,000,000 or 15% of annual turnover for a company.

When does something “have impact on the value of the securities of the company”? What is “significant” in the circumstances where the company operates? What are the strategic aspects that need to be considered when disclosing information to the investors and to the market?

MAR creates the requirement to

Here, as in all communication, consistency is the key. The first documented decisions that are being made can build the bedrock for the future.

Investor strategy is an important factor to be kept in mind in all public communication. The strategic goals in relation to the kinds of investors the company seeks to attract and the “investor experience” that the company aims to give have to be duly reflected. MAR compliance is an opportunity to reinforce the company’s investor relations strategy.

Opportunity to actively create precedents that the future disclosure decisions of the company will be measured against

MAR provides an opportunity to actively create precedents that the future disclosure decisions of the company will be measured against. You can develop, document and ingrain, internally and also to investors and other interest groups, clear definitions for the key terms which are grounded not only on the contents of MAR but also reflect the specific features and circumstances of your company. This of course is not new as such, but has a new twist. Disclosure policies need to provide clear guidelines for the definition of inside information and disclosure process to enable proper precedents to be created. In order to create such proper precedents, your internal thinking may need to go a few steps deeper to find what is core for the company. When the core is pellucid, the decisions in the hectic day-to-day life stay on course. Otherwise, the regular scrutiny which the Financial Supervisory Authority is obligated to conduct under MAR easily catches on unintentional inconsistencies.