In connection with an acquisition of all the outstanding shares in the target company, two minority investors holding 9.5% of the shares in the target company had rolled over their shares to the acquirer’s structure. The roll-over was performed through an exchange of shares, where the minority investors contributed their shares to the acquiring entity in return for newly issued shares.

The Supreme Administrative Court held the decision by the Central Tax Board, according to which the provisions concerning tax neutral exchange of shares were not applicable.

Tax Neutral Exchange of Shares

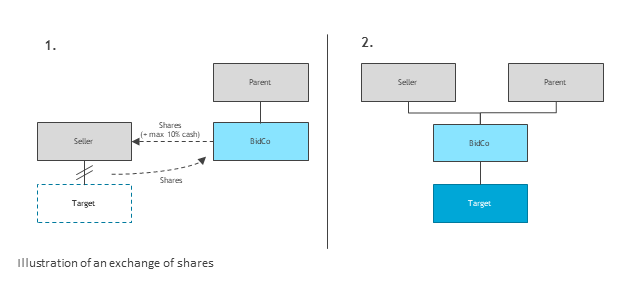

Under the Finnish Business Tax Act, a share exchange is an arrangement where the acquirer obtains a majority of the voting rights in a company (or acquires a further holding if already holding a majority), in exchange for newly issued or treasury shares in the acquiring company. Additionally the consideration can include a cash element; however, it may not exceed 10 % of the nominal value, in the absence of a nominal value, of the amount of share capital of the securities issued in exchange.

A qualifying share exchange is tax neutral in income taxation and no capital gains arise for the seller. The acquisition cost of the acquired shares is the same as the acquisition cost of the transferred shares. If cash consideration is used, the respective part of the shares for which cash is received are considered as disposed and subject to tax.

Case SAC:2020:71

In the case at hand, a private equity investor had agreed to purchase against cash consideration (and in notes payable) 87.3% of the shares in the target company from two private equity sellers. Two minority shareholder companies, holding 9.5% of the shares in the target, had invoked the drag-along provision of the shareholders agreement. The PE investor and the minority shareholders had agreed (in the same SPA as the purchase of the majority) that the minority investors would contribute their shares into the acquiring entity in exchange for newly issued shares.

The taxpayer had argued that the transaction between the private equity investors concerning the majority occurred first, which thereafter enabled the use of the drag-along clause, and therefore the exchange of shares should be treated as a separate transaction. The taxpayer also emphasized that the fact that the transactions occurred during the same day was not relevant.

Even though the exchange of shares with the minority investors was completed without any cash consideration, the Central Tax Board took the view that the whole acquisition should be taken into account when determining whether the exchange of shares qualifies for the tax neutral treatment. The Central Tax Board stated that, as the minority investors had participated in the exchange of shares in connection with an arrangement, in which all the shares in the target company were acquired, the arrangement should be assessed as a whole.

Therefore when determining the maximum permitted cash component, considerations paid to all the sellers should be taken into account. As the purchase price paid between the PE investors for the majority shareholding was in cash, the total consideration paid for the shares in the target company consisted mostly of cash, significantly exceeding the permitted 10% threshold required for tax neutrality. The Supreme Administrative Court held the decision by the Central Tax Board.

Our Insights

The underlying question is one of the evergreens in taxation and it is relevant for both third party transactions and intra-group restructurings alike: “Should the arrangement be looked as a whole or should its parts be evaluated separately when determining the applicable tax treatment?”

In this case the Central Tax Board looked at the acquisition of the majority holding and the exchange of shares with the minority investors as a whole, an interpretation which the SAC later upheld. Even though the decision did refer to the fact that both the majority and minority transactions were agreed in a single SPA it seems that such technical merits alone were not decisive in the case. Rather the mechanics of the entire transaction (being very typical as such) together with its economic outcome resulted in the adverse outcome for the taxpayer.

Despite the ruling, an exchange of shares remains in many cases a useful tool. However, all arrangements involving cash compensation, such as re-investments in particular, need to be carefully analysed in order to avoid adverse tax implication.