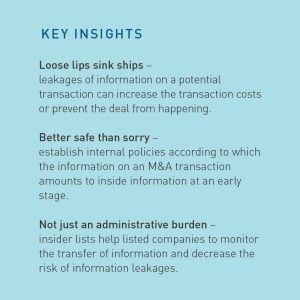

Although confidentiality is crucial in any transaction negotiation, listed companies should pay extra attention to ensuring that the people involved in the deal put a sock in their mouth. Should information on a potential transaction leak to the public too early, there is a risk that the planned transaction hits the rocks. Competing bidders may get interested and speculators, such as hedge funds, may try to drive the targets’ share price up or start bidding on the failure of the transaction.

Criminal charges related to unlawful disclosure and abuse of inside information certainly make their way into headlines. Information on an M&A transaction involving a listed company will often turn to inside information at some stage of the evolving transaction. To avoid information leakages threatening the deal and to prevent criminal prosecution, it is essential to effectively control access to inside information.

Mind Your Step

M&A transactions are lengthy processes involving several steps from the first internal discussion on a potential target to the closing of the transaction. At some stage of the process, the information on the transaction reaches the threshold of inside information triggering an obligation to make a decision on its disclosure. The directors face the challenging task of determining when the information on the transaction actually turns into inside information. Both the probability and the size of the transaction affect whether the information is likely to have a significant effect on the price of the company’s shares. Usually when the size of a transaction is substantial compared to the listed company, the information on the potential transaction amounts to inside information at a relatively early stage.

There are well established reasons why the directors should focus on determining the moment when information on a potential M&A transaction constitutes inside information. When this happens, a listed company must either disclose the inside information to the public or make a decision to delay the disclosure. A company can delay the disclosure where it would be likely to prejudice their legitimate interests provided that this does not likely mislead the public and that confidentiality can be maintained. In practice, listed companies have a more or less permanent interest to delay the disclosure until there is certainty that the deal will be entered into. Early disclosure could attract competing bidders and create incorrect expectations misleading the public.

“As a rule of thumb, listed companies should ensure that the information on an M&A transaction is regarded as inside information at an early stage of the M&A process”

Better Safe than Sorry

It is not unheard of that the target itself or its advisers leak information to the market in the hope of a more preferable bidder (a so called “white knight”) or as another takeover defense tactic to frustrate the bidder or for testing whether there is any room for higher price. Therefore, from the bidder’s perspective, the earlier the information on the potential transaction leaks to the market the higher the risk is that the transaction price or at least transaction costs increase(s). In a worst case scenario, the leakage may prevent the completion of the transaction altogether.

In connection with a decision on delaying disclosure, the listed company must establish a project-specific insider register on persons who have access to the inside information. With the help of the insider register, listed companies are able to monitor who has access to inside information on the transaction. This reduces the risk of leakage and abuse of inside information because the companies must ensure that the persons included in the register have been informed of the prohibition to exploit or disclose inside information.

As a rule of thumb, listed companies should ensure that the information on an M&A transaction is regarded as inside information at an early stage of the M&A process. A predefined low internal limit in the disclosure policy for valuation or strategical materiality of an M&A transaction helps to ensure that information regarding a potential transaction is considered inside information at an early stage and that the persons involved are registered into insider registers soon enough. This “better safe than sorry” approach does not only limit the risk of abuse of inside information, but it certainly is in the interest of the listed company. By defining the information on the planned transaction as inside information, the risks of endangering a successful transaction and competing bids are effectively mitigated.